SIGNIFICANT CHANGES IN THE SUPPLY CHAIN FOR PAPER & BOARD: DECEMBER 2021 UPDATE

In June, we wrote an article titled ‘SIGNIFICANT CHANGES IN THE SUPPLY CHAIN FOR PAPER & BOARD’. This article explored eight reasons why the market for paper and board was changing so rapidly, and explained why the cost of pulp, paper and board continued to increase.

In December 2021, the price of board is still higher than previous years. Many of the factors that we addressed in June are still in play today.

Today, we will revisit the main points investigated, and see if they are still valid in December, 2021.

1. GLOBAL SHIFT AWAY FROM PLASTIC

As per our report in June, there was a strong move to shift away from using plastic globally, particularly in packaging. The natural alternative to plastic packaging is cardboard – thus driving global demand.

This has only continued to increase, as more and more legislation is kicking in globally to look for alternatives to plastic.

Even in NSW, legislation is being implemented in 2022 to ban single-use lightweight plastic bags, straws, stirrers, cotton buds, plates, bowls, cutlery and polystyrene foodservice items.

2. TRANSPORT COSTS – FREIGHT SHIPPING

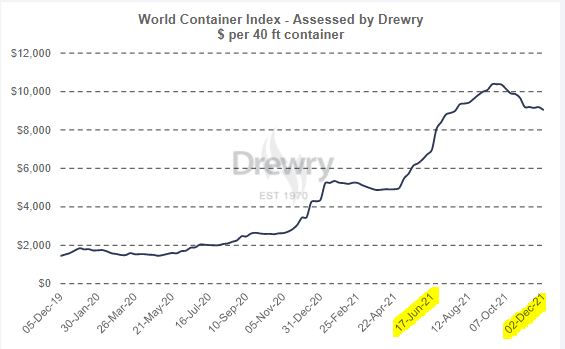

In June, the cost of freight shipping had increased from around $1800 per container in 2020, to $8,000 in June 2021. Prices for shipping containers peaked in September at over $10,000, and are currently still sitting around the $9,000 mark at the time of writing.

It is unclear whether September marks a peak in prices, but experts believe the price of freight will slowly come down as the world continues to open up post COVID.

3. CONTAINER SHORTAGE

In June this year, there was a global shortage of shipping containers. Six months later, the shipping container shortage does not seem to have eased up, and looks like it could continue to get worse, particularly around Christmas time.

4. LOW GLOBAL SCHEDULE RELIABILITY

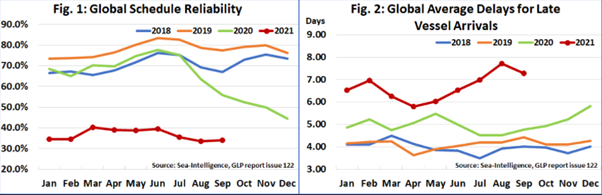

Global schedule reliability has continued to stay low – with reliability continuing to be much lower than previous years – and the average vessel delay taking around 7 days.

5. COVID DRIVEN DEMAND OF ECOMMERCE GOODS AND PREMIUM HOME TISSUE PRODUCTS

In June this year, we discussed how lockdown was causing people to switch to online shopping.

Due to the last two years of lockdown, consumer purchasing behaviour appears to be forever shifted toward online shopping.

In Australia, 84 per cent of consumers made an online purchase in the last three months. Now that Australia is coming out of lockdown, 50 per cent of Australian shoppers expect to use online shopping as their main shopping channel – up from 32 per cent prior to COVID.

E-Commerce goods require paper and board packaging, which has increased with the online shopping trend.

Additionally, as we shifted to WFH, demand for premium home tissue products increased. It does not look like this demand is decreasing at all, as consumers adjust to this new way of life.

5. CONCLUSION

In summary, it looks like the cost of freight might come down eventually. However, due to increased demand globally for pulp, due to a global shift away from plastic, increased e-commerce transactions, and higher demand for premium tissue products, it does not look like the price of board will come down any time soon.