SIGNIFICANT CHANGES IN THE SUPPLY CHAIN FOR PAPER & BOARD

It is important to note that the global supply of market pulp remains strong and steady, despite price increases and logistical challenges that have presented over the last 12+ months due to the changing landscape kick started by the COVID-19 Crisis.

The following article will discuss 8 reasons why this market is changing so rapidly and why the cost for pulp is increasing and affecting paper and board prices.

1. GLOBAL SHIFT AWAY FROM PLASTIC

As legislation kicks in globally to reduce single use plastics, consumers demand less plastic in their products, and the adverse health effects of plastic in our environment continue to shock the world – the demand for alternatives to plastic is rising. A very strong contender for many plastic items involve paper and board as a strong alternative to plastic, particularly in the packaging space.

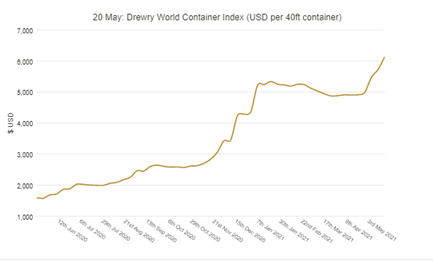

2. TRANSPORT COSTS – FREIGHT SHIPPING

The cost of freight shipping has been increasing exponentially since 2020. This is due to rising global demand for e-commerce goods since COVID-19 significantly changed the way consumers purchase goods. As shown in the chart below, prices have increased exponentially in the last 12 months.

3. CONTAINER SHORTAGE

In addition to the high cost of freight shipping, there is also currently a global shortage of shipping containers. Due to the reduction of cargo ships over the last 12+ months, and global lockdowns, shipping containers have been frequently sitting empty in ports around the world, unable to be utilised to their full efficiency.

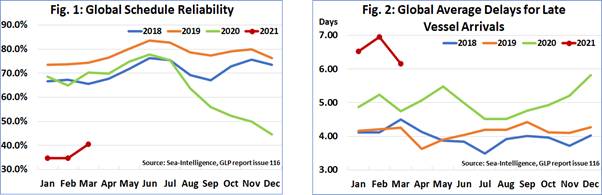

4. LOW GLOBAL SCHEDULE RELIABILITY

Global delays in shipping have been rampant. According to the GLP Report, global reliability is currently the lowest it has been since the benchmark was determined in 2011; over 10 years. The reason for this is primarily changes in operation due to COVID.

5. COVID DRIVEN DEMAND OF ECOMMERCE GOODS AND PREMIUM HOME TISSUE PRODUCTS

6. ENVIRONMENTAL REGULATION LAWS IMPLEMENTED IN CHINA

China has implemented new environmental laws to protect the environment, by restricting the amount of toxic waste that is output by paper mills. By complying with these rules, the cost of producing paper has increased

7. CHINA BAN ON INTERNATIONAL PAPER RECYCLING

In 2017, China introduced laws to prohibit scrap / mixed paper from being sent to China to be recycled, due to the toxic outputs caused by the recycling process. In 2021, China banned all solid waste, including sorted office paper. Previously, China took over 50% of the worlds scrap paper for recycling. This is driving demand for new pulp, as there is not as much paper being recycled.

8. MILL CLOSURES & CAPACITY REDUCTION

Paper is predominantly manufactured in China and Europe and North America. In the last 6 months, more than 10% of North American paper mills have shut down. Additionally, capacity globally has been reduced, as working in a Covid safe environment has required reduced worker capacity.

CCS has been working very closely with our paper and suppliers since the start of the pandemic. We recognised most of the current supply chain issues in an early stage and we have acted timely accordingly.

We have built additional inventory buffer for paper and board and have firsthand access to any available floor stock from our suppliers.

At this stage we have been able to manage and absorb recent price increases for paper and board.

For over 12 months we have increased our inventory and managed to ensure the supply chain difficulties did not impact our customers.

The continued and increased price pressure on paper and board will eventually lead to higher prices to for customers but we will endeavour to manage these in a sensible and professional manner, and ensure that customers are still receiving the absolute best value for their investment.

CCS greatly appreciates the continued business of our clients, and continued support throughout this rapidly changing market landscape. If you have any further queries regarding future price increases, please reach out. Our team is more than happy to discuss this with you.